My Top 3 Investing Priorities

Apr 21, 2021

I’m back baby!

Back to investing that is!

If you follow me on Instagram, you’ve probably heard that 2020 was a financial doozy for me- along with the rest of the whole wide-world. Personally, I had increased financial medical expenses from:

- Breaking my arm — be careful my biking friends!

- Pet care expenses from dog surgery — best money I’ve ever spent, my 17 yr old Jack Russell Elton is feeling better than ever!

- Hurricane Zeta- I moved from Charleston, SC to New Orleans, LA almost 2 years ago and I can’t seem to escape the hurricanes!

However, I still have over a million things to be grateful for and here’s the good news from 2020: I had a solid emergency fund to cover the $15,000 of extra expenses. If I didn’t have this safety net I would be deep in debt and it would have been a massive financial set back. So, before you start getting serious about investing, make sure you complete all the items on this checklist or take the 2 minute quiz to find out how ready you are to invest!

It took me 3 months of spending less, saving more, paying off debts, and finding extra income- but I was able to get back on track by completing the below:

Back to Investing

Now that the basics are done, I have the extra cash flow available to invest! As the last item on this checklist says, when you start investing, it’s really important to have an actual strategy!

So, for the next year I’ve identified a few areas of the investing world that I’m excited to check out. Before I disclose, this will be slightly different from my main 401k portfolio. If you’re interested, you can check out my 401k allocation strategy here.

My investing goals for the next 12 months

Here are my investing goals for the next 12 months beyond maxing out my 401k and HSA.

- Max out a Roth IRA with a 3-fund strategy.

- In a non-retirement account:

- Environmental & Socially Responsible Funds

- Dividend paying individual stocks

3. Bonds, Cryptocurrency & Real Estate

- High paying bonds

- Cryptocurrency

- Sinking fund for our next real estate investment

Keep reading to dive in deeper and get a glimpse on how I plan to execute this strategy.

A side note:

I will be disclosing the companies and platforms I’m using. I’ll add links but please know that I have no affiliates to these companies. Also, these strategies can be used on multiple platforms, so do a little research and chose whatever options work best for you.

But beware: Analysis paralysis is real! Take a few hours or a day to research, but don’t let researching cause you to delay your investment strategy. Time is the what makes compound interest one of the most powerful forces on Earth. Remember, worse case scenario if you really end up disliking a platform- you can always switch!

Another caveat:

I will be disclosing what funds I’m looking at with a lot of these strategies. With that being said, I write these blogs and do tutorials because I want to teach you and encourage you to do your own research.

Your risk tolerance might be different than mine. You may want to stick with exchange traded or mutual funds and not pick individual stocks or bonds. Your core values may push you to invest in certain business sectors or geographical regions. The point is, I’m not you and personal finance is… personal.

Additionally, you should never invest in something just because someone else is doing it. Remember that thing your Mom used to say about your friends jumping off the bridge, yeah- that applies here too. Plus, if you’re just doing what someone else says you’ll never learn anything, except for how to follow instructions. So, I’m providing you what I’m doing as an example only and I hope it encourages you to put in a little work, make your own strategies, start small and make it happen!

Roth IRA Strategy

My strategy for this account will be really similar to mirroring my 401k portfolio.

I’m using Fidelity for my Roth IRA. Simply because they also have a wonderful credit card I use. The Fidelity Visa card earns 2% on every purchase and you can add your rewards to your investment account or pay down your balance. You can check out more here.

In my Roth IRA I plan to use a 3-fund strategy.

- 50% US Total Stock Mix (FZROX)

- 40% International Total Stock Mix (minus US) (FTIHX)

- 10% Aggregate US Bond Fund (AGG)

I’m hoping to follow the long term increase in the US Stock Market and add in some balance to the returns with International Stocks (which include emerging funds) and the Bond Fund.

Also, there are many funds within Fidelity that follow these markets. I picked these because they had some of the lower expense ratios (fees).

Individual Investment Account Strategy

I already have an individual investment account. That account currently has holds 20% of ETFs & Mutual Funds, and 80% of individual stocks. The stocks are 34% dividend and 66% growth. 20% of that is also stock from an old employer.

While we’re on the topic of dividend and growth funds, let’s quickly review how you actually make money in the market.

- Dividends

- Growth/ Appreciation

Growth stocks sound more exciting- think Tesla gaining over 60% last year. However, these stocks can also be more volatile and add more risk. When a company hasn't been around a long, it’s harder to predict what changing market conditions, management, or the economy can do to that company.

I personally really relate to investing in dividends. Think of dividend paying stocks like a rental home. You buy the stock (home) and then collect the rent (dividend) every year. As long as the renters are paying their rent (dividends) you could care less about what the value of the home (stock price) is on a day-to-day basis! Pretty awesome- right!

This is why 70% of this account will be dedicated to dividend stocks. A few of the stocks I’m looking at are: Home Depot (HD), Johnson and Johnson (JNJ), Iron Mountain (IRM) and AT&T (T).

The other 30% of the funds in this account will be dedicated to Environmental & Socially Responsible Funds. First, let’s define what these funds are. Here’s the exact wording from Fidelity:

All Socially Responsible ETFs utilize a methodology that picks or rejects constituents based on three central factors in measuring the sustainability and ethical impact of an investment in a company: Environmental, Social and Governance (ESG). This can include the consideration of social, human, manufactured and natural capital as well as faith-based ideals. Results are sorted by Net Assets and exclude ETNs, Schedule K-1 Issuers, and leveraged or inverse products.

Being an eco-friendly consumer is one of my core-values — just ask my family who finds it annoying when I pressure them to recycle and reuse items. I’ve also committed to buying only sustainable clothing, and we do our best to eat veggies from our garden and compost what we can.

The point is, why not carry over this core value to my investment portfolio? I’m starting with a low amount because many of these funds have not been around for a long time and I’m not 100% sure how they’ll perform. I’m betting they’ll perform well, only because of the current administration's focus on more environmentally friendly legislation, but we will see! Perhaps I’ll do a 1-year review next year. The first fund I started with is MSCI Global Impact ETF (SDG).

Bonds, Cryptocurrency & Real Estate

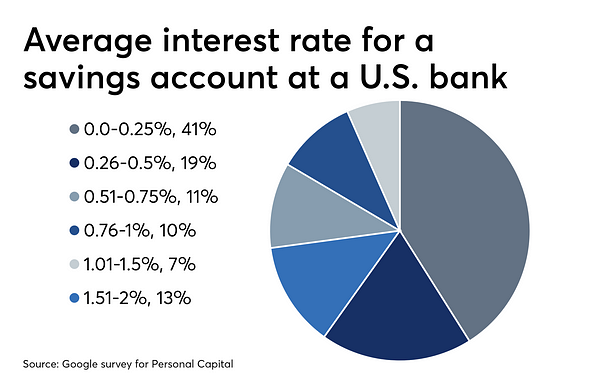

Are you tired of earning *maybe* .5% in your emergency high- yield savings account? Yeah, me too. Unfortunately, I’ve got bad news for you in that department. The Fed just released yet another statement saying that they are planning on keeping interest rates low. So the ‘high-yield’ savings account will in fact not have a very high yield, at least for the immediate future.

This is why I’ve made the decision to place some of my emergency savings into bonds. I’m using Worthy Bonds. They pay 5% and allow withdrawals. I’m planning on starting with 20% of my emergency fund and bring it up to 50% after awhile. You can learn more here.

Ok, so it’s happening. No, I’m not getting married Mom. I’m investing in cryptocurrency. I’m certainly not a crypto-expert so I won’t elaborate too much here, but from the research I’ve done, I’m convinced that cryptocurrencies are not going away and are going to playing a big part in the global economy of the future.

Personally, I’m starting with Ethereum. At this point in time it seems to be one of the more underpriced currencies. I have not decided on a platform yet, but am leaning towards Coinbase. However, in talks with more experience cryptocurrency investors Binance and CEX seem to also be great platforms. The main importance with cryptocurrency — I want to keep my exposure to around .75% of my total investment funds. This may change in the future, but this is my personal comfort level for now.

I love a long list of things and real estate is one of them. If you’ve seen memes about scrolling on Zillow, know that this is me. As a side note, this was one of the funniest SNL skits I’ve seen in a long while!

Anyway, we have one investment property currently, that for all it’s aches, pains, repairs, and tenet issues- it’s been a solid investment. The problem with real-estate is that even with hard lenders and excellent credit- it can be a capital heavy investment. Basically, I need to save a good chunk of cash before buying another house. So having a savings account specifically for this is key.

Have you ever read the book, The Automatic Millionaire? I recommend it if you haven't! The book is about creating strategies to automate most of your finances- which can help you accomplish your goals by taking away the temptation to spend more than your planned and veer away from your strategy.

I love this premise, use it myself, and recommend it for my clients. This is also why I’ve written these strategies in terms of percentages. That way if my cashflow changes, I can fairly easily change my automations.

So for my investment strategy, my money AUTOMATICALLY flows from when my paycheck hits my account to my investment accounts. Then I go in once every month to purchase the funds listed. See below for a good example.

Again, I hope sharing this strategy with you helps you think about your own investment strategy.

If you’re just getting started: start simple, start small, and start right away.

Make any mistakes and increase your confidence with small amounts of money and grow from there- you got this!

Disclosure: This blog is written as a guide for general use and educational purposes only. Information is not meant to be taken as explicit financial advice. I am not a licensed financial advisor, boker, underwriter, or tax professional. All opinions are based on my own personal and professional experience. As with any major decisions, please do your own research when making any investment or financial decisions.